Market Outlook: Is a Fixer-Upper the Right Choice for You?

Are you feeling discouraged by high home prices and wondering if owning a home is even possible? There’s still a way to achieve homeownership, even when affordability feels like a major challenge: consider a fixer-upper. Let’s explore how this option can help you take the first step into homeownership and what it takes to make it work.

What Is a Fixer-Upper?

A fixer-upper is a home that’s move-in ready but needs varying levels of updates or repairs. Some may require simple cosmetic changes, like fresh paint or new flooring, while others might need more significant improvements, such as roof replacements or plumbing upgrades.

Since these homes often require some level of effort to enhance, they’re typically priced lower than comparable move-in-ready homes. In fact, a study by StorageCafe reveals that fixer-uppers are generally priced about 29% below market value.

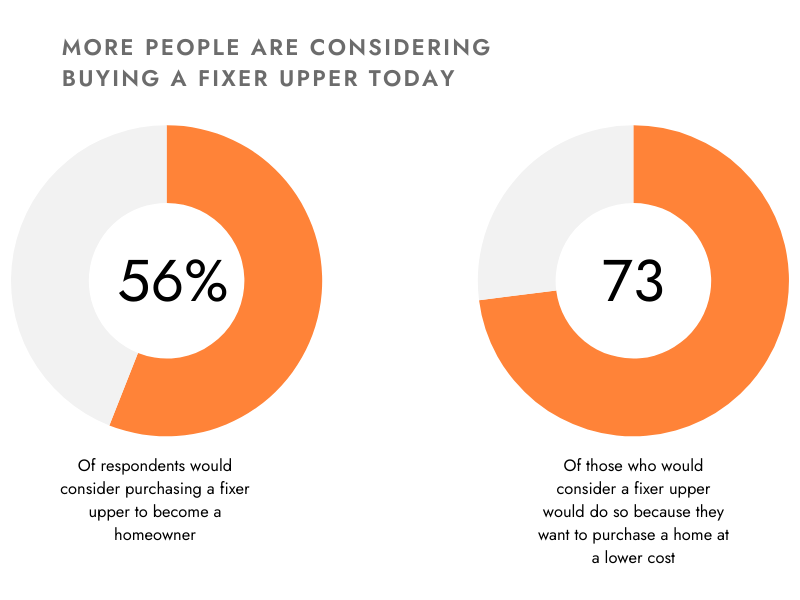

This affordability is one reason why more buyers are considering fixer-uppers as a viable option (see graph).

If you’re prepared to invest time and effort, a fixer-upper could be a great way to enter the housing market while unlocking a home’s untapped potential.

Tips for Buying a Fixer-Upper

Before committing to a fixer-upper, here are a few key considerations:

- Location Matters: While you can update a home, you can’t change its location. Look for properties in neighborhoods with rising property values, growing amenities, or a community vibe you love. This ensures your investment will likely grow in value over time.

- Budget for the Unexpected: Renovations often come with surprise costs. Be sure to set aside additional funds for unplanned repairs or unforeseen issues.

- Get a Professional Inspection: Always have the home professionally inspected before purchasing. An inspector can identify potential repairs so you can make an informed decision and avoid costly surprises.

- Prioritize Your Projects: Divide your renovation goals into three categories: essentials (repairs you need to address immediately), conveniences (upgrades that make life easier), and future luxuries (features you can add over time). This approach will help you stay on track and within budget.

The beauty of a fixer-upper is its potential to become the perfect home after purchase. With a clear plan, budget, and vision, you can transform a property that needs work into a customized space you’ll love.

How The Caroline K. Huo Group Can Help

Our team is invaluable when searching for homes with potential. Our knowledge of the local market can guide you toward properties where strategic improvements could increase value. We can help you find a home that meets your budget while offering opportunities for meaningful upgrades.

In today’s market, where affordability can feel out of reach, finding a move-in-ready home within budget may be challenging. However, a fixer-upper allows you to craft your ideal home while saving on the initial purchase price. With the support of a local real estate agent, you can uncover opportunities to create a home that meets your needs—and your budget.

Selling a home or buying a fixer-upper can feel overwhelming, but that’s where we come in! For our seller clients, we specialize in renovating homes to ensure they’re market-ready and attract the best possible offers. We bring that same expertise to our buyer clients, helping them transform fixer-uppers into their dream homes.

Discover how we guide you every step of the way, from concept to completion. Learn more about what we can do for you here and explore our expert resources here.

MY TAKE

Caroline's take on what you need to know

In today’s competitive housing market, finding a move-in-ready home that fits within your budget can be challenging. However, considering a fixer-upper offers a unique opportunity for buyers to enter the market at a lower price point while gaining the chance to customize and add value over time. While the process of renovating may seem daunting, the long-term benefits can be significant, especially if the property is located in a growing neighborhood with strong future potential.

It’s important to approach a fixer-upper with a clear plan, a realistic budget, and a vision for what the home can become. With the right guidance from a knowledgeable real estate agent, this path can lead to both financial and personal rewards, offering you the opportunity to transform a house into your ideal home without stretching your finances.

Contact us today to discuss your specific situation and develop a personalized strategy to achieve your real estate goals.

Market Report November 2024

Here's the latest October 2024 Market Update showing year-over-year data. The data includes all Single-family homes, condos & Townhomes in the California Area sourced from MLS Listings for the period from August September thru October 2024. This may include preliminary data and may vary from the time this data was gathered. All data is deemed reliable but not guaranteed.

FOR NEWS INQUIRIES

Kyle Henry

Director of Marketing

Kyle.H@CarolineHuo.com

650.727.1308

Share & Stay in the Know