Market Outlook: Navigating Your 2025 Home Buying Journey: A Comprehensive Guide

The advent of a new year invariably inspires reflection and the setting of ambitious goals. For many, these aspirations may include the allure of a new home – a sanctuary that perfectly reflects their evolving needs and desires. However, the path to realizing this dream can appear daunting. Where does one begin? How does one navigate the complexities of the modern real estate landscape?

This guide aims to provide discerning individuals like yourself with the insights and strategies necessary to successfully embark on your 2025 real estate journey.

Unveiling Your "Why": The Cornerstone of Your Pursuit

Before embarking on any significant endeavor, it is imperative to understand the underlying motivation. While financial considerations are undeniably crucial, the emotional drivers behind your desire for a new home hold immense significance.

Perhaps you envision a spacious haven to accommodate a growing family, a serene retreat to embrace a quieter lifestyle, or an investment property to secure your future. Whatever your "why," it serves as the guiding star, illuminating your path and providing unwavering resolve amidst the inevitable challenges.

Articulating Your Needs: Defining Your Dream Abode

With your "why" firmly established, it is time to meticulously define the attributes of your ideal residence. Consider the essential elements: the number of bedrooms and bathrooms, the desirability of a dedicated home office, the importance of outdoor space, and the proximity to desired amenities.

Furthermore, it is crucial to acknowledge the constraints imposed by the current market. While unwavering in your pursuit of essential features, consider areas where flexibility can be exercised. Perhaps a slightly more remote location can be considered if it affords access to other coveted attributes.

Financial Foundations: A Prudent Approach

A sound financial strategy is paramount to the success of any real estate endeavor.

- Assess Your Financial Capacity: Conduct a thorough evaluation of your financial resources. Determine an appropriate savings target for a substantial down payment and establish a comfortable monthly mortgage payment budget.

- Leverage Professional Expertise: Engage the services of a reputable financial advisor and a qualified mortgage lender. These professionals can provide invaluable guidance on:

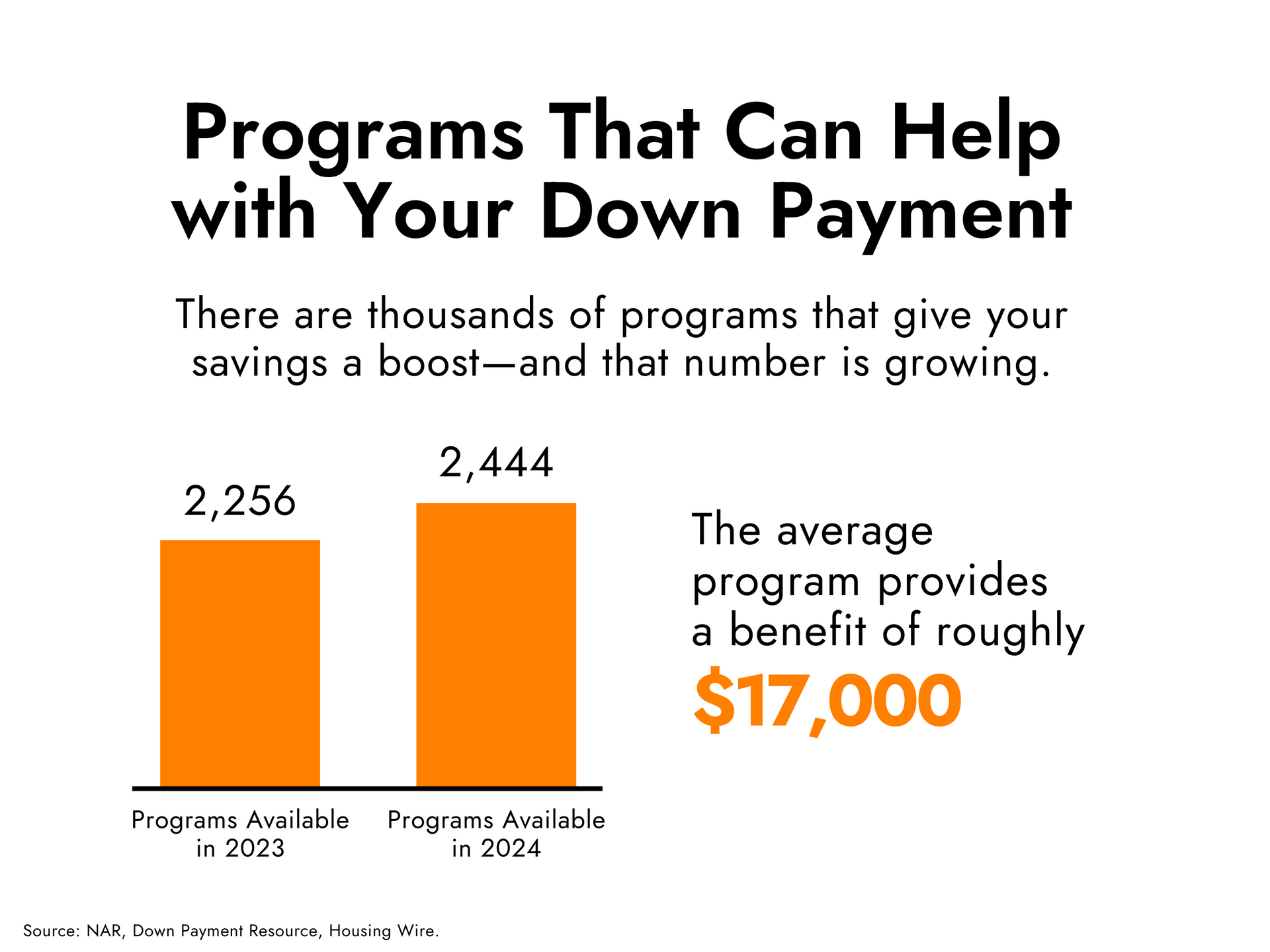

- Down Payment Assistance Programs: Explore available options to bridge the gap between your savings and your desired down payment.

- Equity Utilization: If you are a current homeowner, assess the equity available in your existing property and explore strategies to leverage it towards your next move.

- Mortgage Pre-Approval: Obtain pre-approval for a mortgage to gain a clear understanding of your borrowing capacity and enhance your negotiating position in the market.

Navigating the Path to Success: Debunking Common Myths

It is crucial to address some common misconceptions that can hinder the home buying journey.

- Myth 1: Pre-qualification is Sufficient

- Reality: A pre-approval not only strengthens your negotiating position but also provides you with a clearer understanding of your purchasing power.

- Myth 2: Inspection Contingencies Must Be Waived

- Reality: A thorough inspection is crucial to uncover potential issues that could impact your investment. While negotiating flexibility on minor repairs is often possible, it is unwise to entirely relinquish the protection afforded by an inspection.

- Myth 3: A 20% Down Payment is Mandatory

- Reality: It is not always a prerequisite. Explore alternative financing options, such as FHA loans, which may require lower down payments. Furthermore, investigate available down payment assistance programs that can help you bridge the gap towards homeownership.

The Invaluable Guidance of a Real Estate Professional

Navigating the intricate world of real estate can be a complex and time-consuming endeavor. The expertise of a seasoned real estate professional can prove invaluable throughout your journey.

- Market Insights: A knowledgeable agent possesses an in-depth understanding of local market trends, pricing dynamics, and inventory availability.

- Strategic Guidance: Your agent will provide invaluable counsel on preparing your property for sale, negotiating offers, and conducting thorough due diligence during the home-buying process.

- Personalized Support: Throughout every step of the transaction, your agent will provide unwavering support, addressing your concerns and ensuring a smooth and successful outcome.

The pursuit of a new home represents a significant milestone in life. By embracing a proactive and informed approach, grounded in a clear understanding of your motivations, a well-defined set of needs, and a robust financial foundation, you can confidently navigate the challenges of the market and ultimately achieve your real estate aspirations.

MY TAKE

Caroline's take on what you need to know

As we step into a new year, many of you are eyeing a major milestone—purchasing your ideal home. This period, especially the quieter winter months, offers a strategic advantage with less competition and a market ripe for negotiation. Understanding why you want to move—be it for more space, a lifestyle change, or an investment—guides your decisions and sharpens your focus.

A robust financial strategy is crucial; knowing your budget and exploring mortgage options can significantly enhance your purchasing power. With professional guidance, you can smoothly navigate these steps and avoid common pitfalls.

If you’re ready to make your move, reach out. Let's tailor a strategy that maximizes your opportunities this year. Start your journey with a no-obligation consultation—contact us today!.

If you’re ready to make your move, reach out. Let's tailor a strategy that maximizes your opportunities this year. Start your journey with a no-obligation consultation—contact us today!

Market Report January 2025

Here's the latest January 2025 Market Update showing year-over-year data. The data includes all Single-Family and Condo & Townhomes in the California Area sourced from Broker Metrics & Info Sparks for the period from December 2023 thru December 2024. This may include preliminary data and may vary from the time this data was gathered. All data is deemed reliable but not guaranteed.

FOR NEWS INQUIRIES

Kyle Henry

Director of Marketing

Kyle.H@CarolineHuo.com

650.727.1308

Share & Stay in the Know