LET'S

CONNECT

The Caroline K. Huo Group

DRE# 01419566

DRE #01906450

SF BAY AREA | Keller Williams Peninsula Estates

DRE #01934115

ORANGE COUNTY | Keller Williams Laguna Niguel

Market Connection: August 2024 Market Outlook and Report

3 Reasons Why We’re Not Headed for a Housing Crash

The housing market is always a hot topic, and concerns about a potential crash can make anyone uneasy. However, the current market dynamics are very different from those that led to the 2008 crisis. Here are three compelling reasons why we’re not headed for another housing crash:

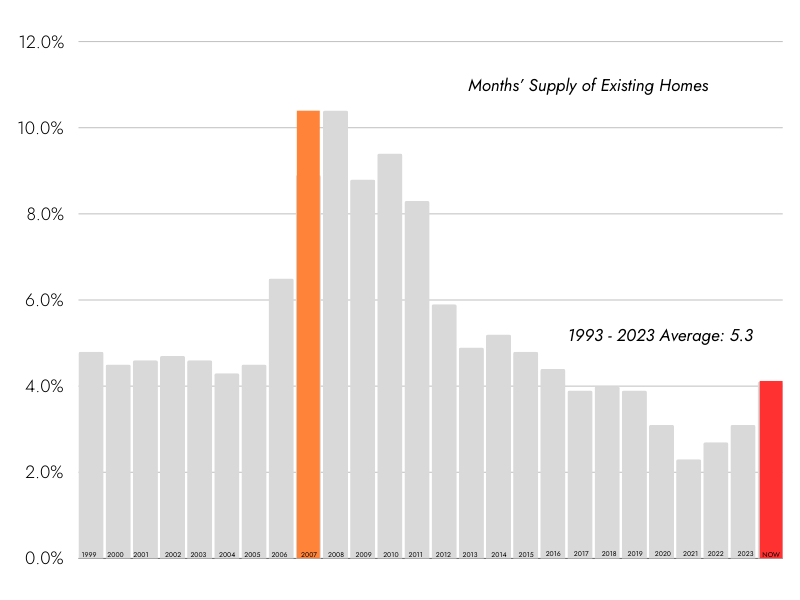

1. Inventory of Homes for Sale is Still Below Normal

One of the most significant indicators of a stable housing market is the inventory of homes available for sale. Historically, a balanced market has around 5.3 months of inventory, which is the average from 1993 to 2023. Currently, we're still below this average, which means there’s less risk of a surplus driving down prices. The limited supply helps maintain home values, reducing the likelihood of a crash.

(Even though supply of existing previously owned homes is growing, It's still low.)

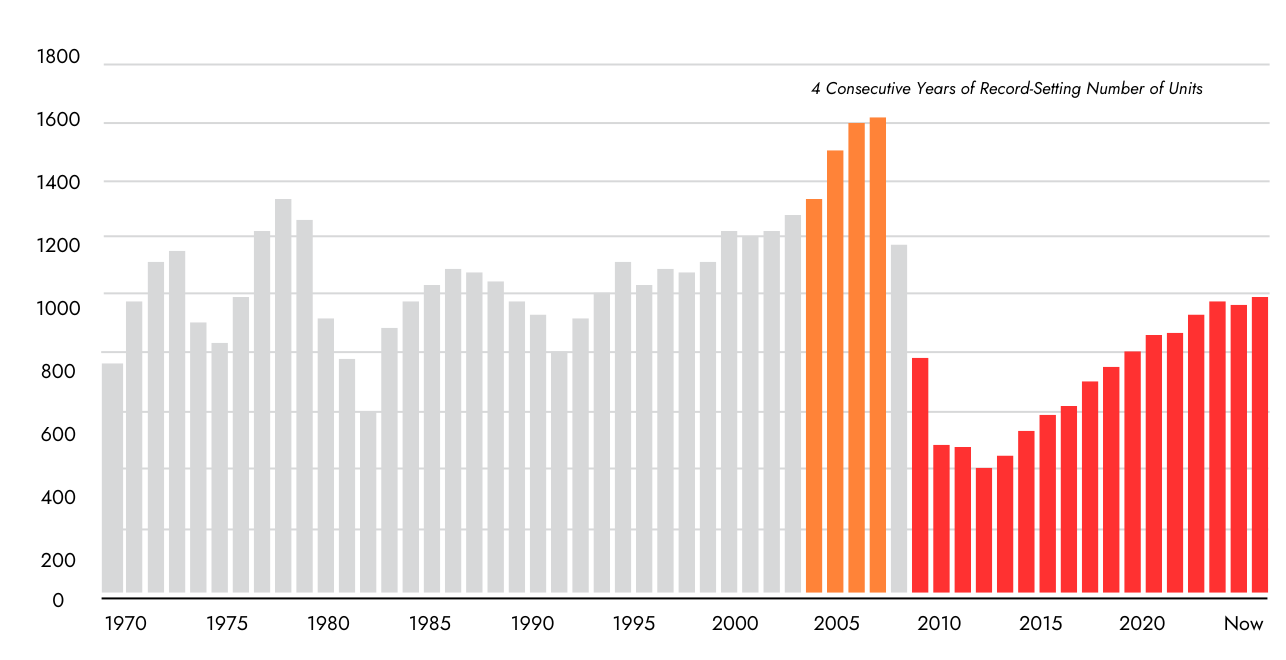

2. Builders Aren't Overbuilding; They're Catching Up

Before the 2008 crash, there was a wave of overbuilding that flooded the market with new homes. Today, that’s not the case. Builders are working to catch up after more than a decade of underbuilding, and single-family housing units are being completed at a steady pace. This careful approach to construction means we’re not seeing the same glut of homes that contributed to the last crash, making the market more resilient.

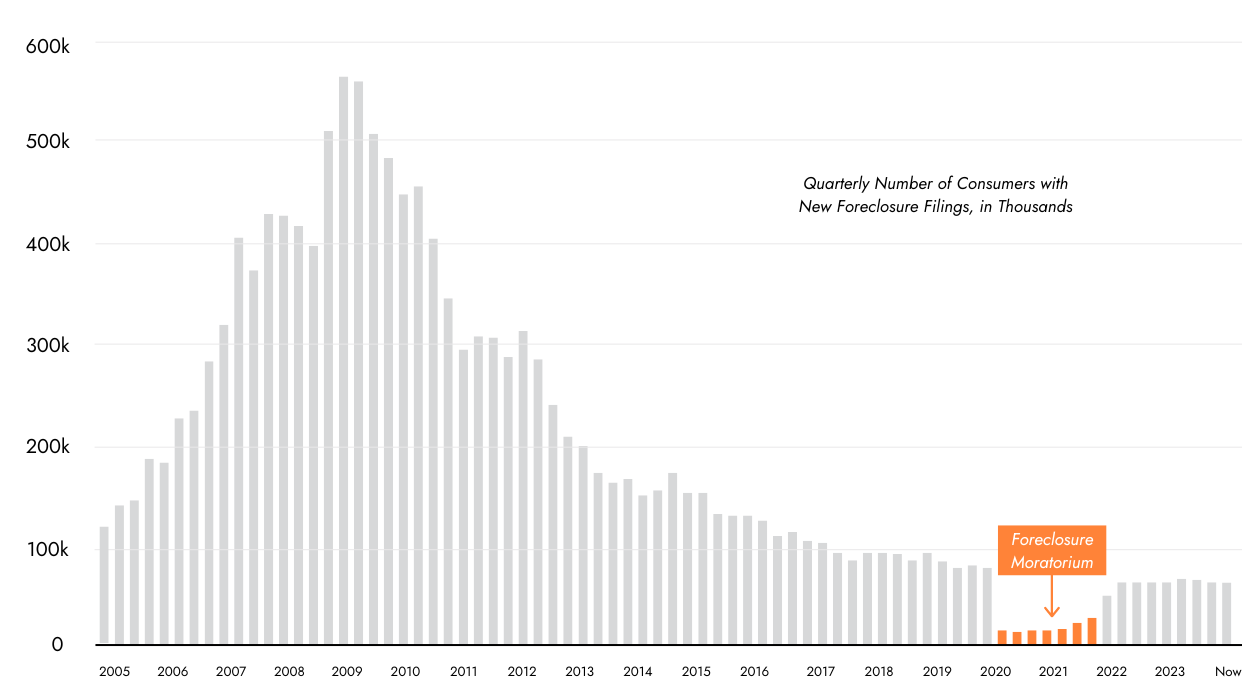

3. Foreclosure Filings Are Still Very Low

During the housing crash, foreclosures spiked dramatically as many homeowners found themselves unable to repay their loans. In contrast, today’s market is seeing very low levels of foreclosure filings. The quarterly number of consumers with new foreclosure filings remains in the thousands, but this is far from the crisis levels we saw in the past. The low foreclosure rate reflects the stronger financial position of most homeowners, further reducing the risk of a market collapse.

"We will not have a repeat of the 2008–2012 housing market crash. There are no risky subprime mortgages that could implode, nor the combination of a massive oversupply and overproduction of homes". -Lawrence Yun, Chief Economist, NAR

While it's natural to be cautious about the future, the current housing market is built on a solid foundation. Unlike the conditions leading up to the 2008 crash, today’s market is supported by lower inventory levels, responsible building practices, and a stable rate of foreclosures. As Lawrence Yun, Chief Economist at NAR, wisely noted, we’re not facing the same risky elements that once led to a catastrophic downturn. The housing market may experience fluctuations, but a crash is not on the horizon.

MY TAKE

Caroline's take on the latest market trends

In today’s market, it’s understandable to feel concerned about a potential housing crash. However, a closer examination reveals that the underlying fundamentals are far stronger than in the past. Inventory levels remain well below historical norms, builders are proceeding with caution, and foreclosure rates are still low. Unlike the conditions that led to the 2008 crash, today’s market shows no signs of the same vulnerabilities.

Contact us today to discuss your specific situation and develop a personalized strategy to achieve your real estate goals.

Market Report August 2024

Here's the latest August 2024 Market Update showing year-over-year data. The data includes all Single-family homes, condos & Townhomes in the California Area sourced from MLS Listings for the period from July August thru August 2024. This may include preliminary data and may vary from the time this data was gathered. All data is deemed reliable but not guaranteed. Content from this article is courtesy of Keeping Current Matters.

FOR NEWS INQUIRIES

Kyle Henry

Director of Marketing

Kyle.H@CarolineHuo.com

650.727.1308

LET'S connect

The Caroline K. Huo Group

DRE# 01419566 | MLS ID 70010141

PROUDLY SERVING THE SF BAY AREA

Keller Williams Advisors | DRE #01906450

Each office is independently owned and operated.

Contact Us

Hello there, we’ve got your submission. We’re reviewing and will reach out soon.

We’re looking forward to speaking with you!

Please try again later.