Market Connection: March 2024 Market Outlook and Report

Your Home Is a Powerful Investment

Going into 2023, there was a lot of talk about a possible recession that would cause the housing market to crash. Some in the media were even forecasting home prices would drop by as much as 10-20%—and that might have made you feel a bit unsure about buying a home.

But here’s what actually happened: home prices went up more than usual. Brian D. Luke, Head of Commodities at S&P Dow Jones Indices, explains:

“Looking back at the year, 2023 appears to have exceeded average annual home price gains over the past 35 years.”

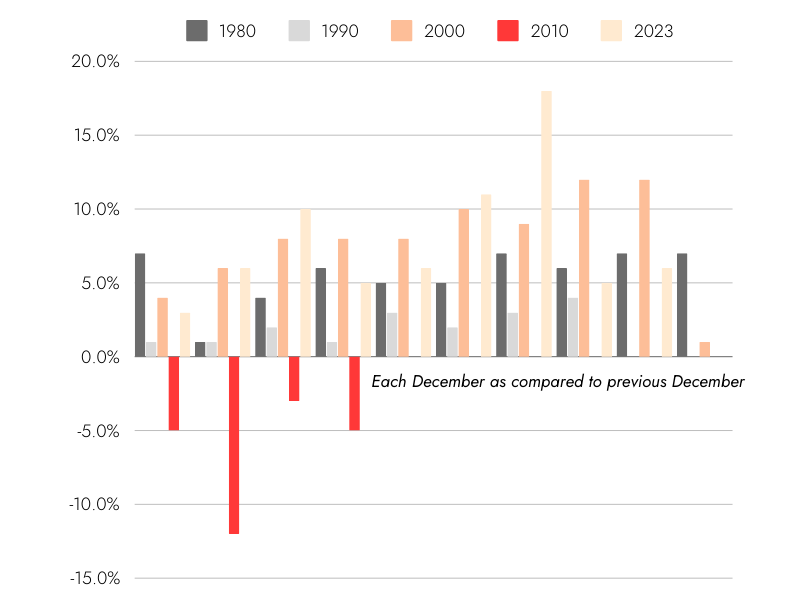

To put last year’s growth into context, the

graph below uses data from

Freddie Mac on how home prices have changed each year going back to 1980. The dotted line shows the long-term average for appreciation:

Percent of Annual Home Appreciation

1980-2023, Seasonally Adjusted, Rounded to nearest full number.

The big takeaway? Home prices almost always go up. As an article from Forbes says:

“. . . the U.S. real estate market has a long and reliable history of increasing in value over time.”

In fact, since 1980, the only time home prices dropped was during the housing market crash (shown in red in the graph above). Fortunately, the market today isn’t like it was in 2008. For starters, there aren’t enough available homes to meet buyer demand right now. On top of that, homeowners have a tremendous amount of equity, so they’re on much stronger footing than they were back then. That means there won’t be a wave of foreclosures that causes prices to fall.

The fact that home values went up every single year except those four in red is why owning a home can be one of the smartest moves you can make. When you’re a homeowner, you own something that typically becomes more valuable over time. And as your home’s value appreciates, your net worth grows.

As your net worth grows, it's important to remember that your home isn't just a place to live, it's an investment! With your home, there are so many ways you can leverage it to reach your financial goals, like:

- Grow your net worth: Use home equity to buy a rental property. Rent pays the mortgage and builds wealth.

- Upgrade & Increase Value: HELOCs can finance renovations that boost your home's value for a bigger payday when you sell.

- Fund Life Goals: HELOCs can help pay for college, consolidate debt, or launch a business.

With consistently increasing home values, owning a home makes more sense than many other investments. It's one of the only investments we know of where you can invest with as little as 5% of the total investment cost, and that offers you cash flow, tax breaks, equity building, competitive risk-adjusted returns, and a hedge against inflation.

If you are thinking about investing in real estate, register to join our upcoming workshop or contact us to discuss your goals.

MY TAKE

Caroline's take on the latest market trends

Your home is more than a place to live. It's a launchpad for wealth building! Leverage equity to become a landlord, invest in renovations, or even fund life goals like education. Remember, it's a tool, use it wisely. Talk to a pro to make your homeownership a springboard to financial success.

Contact us today to discuss your specific situation and develop a personalized strategy to achieve your real estate goals.

Market Report March 2024

Here's the latest February 2024 Market Update showing year-over-year data. The data includes all Single-family homes, condos & Townhomes in the California Area sourced from MLS Listings for the period from January 2023 thru January 2024. This may include preliminary data and may vary from the time this data was gathered. All data is deemed reliable but not guaranteed. Content from this article is courtesy of Keeping Current Matters.

FOR NEWS INQUIRIES

Kyle Henry

Director of Marketing

Kyle.H@CarolineHuo.com

650.727.1308

Share & Stay in the Know