LET'S

CONNECT

The Caroline K. Huo Group

DRE# 01419566

DRE #01906450

SF BAY AREA | Keller Williams Peninsula Estates

DRE #01934115

ORANGE COUNTY | Keller Williams Laguna Niguel

Market Connection: July 2024 Market Outlook and Report

The Crucial Importance of Your "Asking Price" in Today's Market

If you're thinking about selling your house in the San Francisco Bay Area, there's a crucial point you need to understand. Even though it's still a seller's market, you can't just set any price for your home.

Home prices are still appreciating in most parts of the Bay Area, but the pace has slowed due to higher mortgage rates keeping a cap on many buyer's financial capability. At the same time, the supply of homes for sale is increasing, albeit more slowly, giving buyers more choices. This means your house may not stand out if it's not priced correctly.

These two factors make the asking price for your house more critical today than in recent years.

Some sellers are learning this the hard way, leading to more price reductions. Mike Simonsen, Founder and President of ALTOS Research, explains: "Looking at the price reductions data set... It all fits in the same pattern of increasing supply and homebuyer demand that is just exhausted by high mortgage rates. As home sellers are faced with less demand than they expected, more of them have to reduce their prices."

This is because they haven't adjusted their expectations to today's market. They might not be working with an agent, so they're unaware of current trends. Or they're not using an agent who is a local market expert. Either way, they're not basing their pricing decisions on the latest data – and that's a mistake.

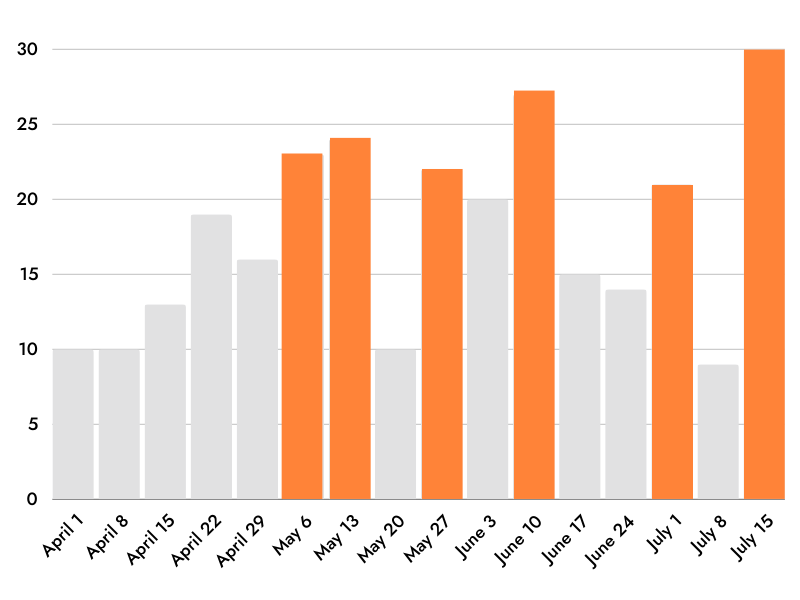

Let's take a look at what's happening in San Mateo County.

The data shows that the number of price reductions has dropped significantly after June 2024. This suggests that buyers are more receptive to listings priced competitively from the start.

This is crucial for Bay Area sellers to consider. By accurately pricing your home based on current market conditions, you can attract more qualified buyers during the summer months when there's typically less activity. You'll also face less competition from other overpriced houses that may sit on the market for longer.

To avoid making pricing mistakes that could turn away buyers and delay your sale, you need to work with an agent who truly understands the Bay Area market. A knowledgeable agent will help you avoid common pitfalls like:

- Setting a Price That’s Too High: Some sellers have unrealistic expectations about their home's worth, basing their price on their gut feeling or personal financial goals rather than market data. An agent will help you set a price based on facts, increasing your chances of selling quickly.

- Not Considering What Houses Are Actually Selling For: Without an agent, sellers may use incorrect comparable sales (comps) and misjudge their home's market value. An agent has the expertise to find accurate comps and provide valuable insights into pricing your house competitively.

- Overestimating Home Improvements: Sellers who have invested heavily in home improvements may overestimate their impact on the home's value. While some upgrades can enhance appeal, not all provide a high return on investment. An agent will consider what improvements matter most to buyers in your area when setting the price.

- Ignoring Feedback and Market Response: Some sellers resist lowering their asking price based on open house feedback. An agent will remind you of the importance of being flexible and responsive to market feedback to attract qualified buyers.

In the end, accurate pricing depends on current market conditions that change week to week. The right agent will use this knowledge to develop a pricing strategy based on market conditions, ensuring your house gets sold.

Don't miss out on a great opportunity!

Contact our team to help you price your Bay Area home competitively to attract summer buyers and minimize the risk of price reductions. By setting a realistic asking price from the beginning, you'll be well on your way to a successful sale.

MY TAKE

Caroline's take on the latest market trends

Don’t just focus on the listing price—look deeper into the market conditions. With higher mortgage rates and more homes on the market, setting an accurate price is crucial.

Here’s how to be a savvy seller:

- Work with a Local Expert: An experienced agent can help you set a realistic price based on the latest data.

- Stay Informed: Understand buyer behavior and market trends.

- Be Flexible: Listen to feedback and be ready to adjust your price if needed.

- Showcase Your Home’s Strengths: Highlight what makes your home unique.

By working with a knowledgeable agent and staying informed, you can navigate the selling process smoothly and achieve a successful sale in the Bay Area.

Contact us today to discuss your specific situation and develop a personalized strategy to achieve your real estate goals.

Market Report July 2024

Here's the latest July 2024 Market Update showing year-over-year data. The data includes all Single-family homes, condos & Townhomes in the California Area sourced from MLS Listings for the period from June July thru July 2024. This may include preliminary data and may vary from the time this data was gathered. All data is deemed reliable but not guaranteed. Content from this article is courtesy of Keeping Current Matters.

FOR NEWS INQUIRIES

Kyle Henry

Director of Marketing

Kyle.H@CarolineHuo.com

650.727.1308

LET'S connect

The Caroline K. Huo Group

DRE# 01419566 | MLS ID 70010141

PROUDLY SERVING THE SF BAY AREA

Keller Williams Advisors | DRE #01906450

Each office is independently owned and operated.

Contact Us

Hello there, we’ve got your submission. We’re reviewing and will reach out soon.

We’re looking forward to speaking with you!

Please try again later.