Market Outlook: Here’s What a Recession Could Mean for the Housing Market

Recession talk is all over the news, and the odds of a recession are rising this year. And that leaves people wondering what would happen to the housing market if we do go into a recession.

Let’s take a look at some historical data to show what’s happened in housing for each recession going all the way back to the 1980s.

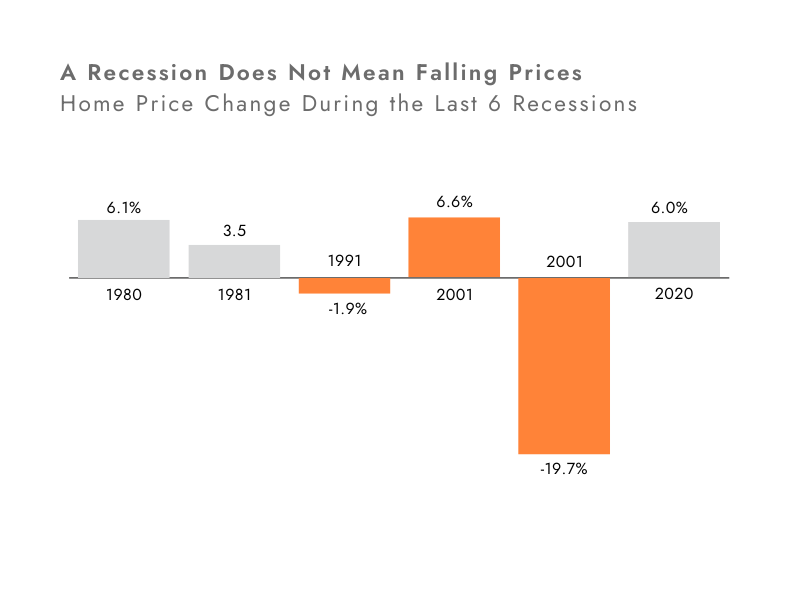

A Recession Doesn’t Mean Home Prices Will Fall

Many people think that if a recession hits, home prices will fall like they did in 2008. But that was an exception, not the rule. It was the only time we saw such a steep drop in prices. And it hasn’t happened since.

In fact, according to data from CoreLogic, in four of the last six recessions, home prices actually went up (see graph below):

So, if you’re thinking about buying or selling a home, don’t assume a recession will lead to a crash in home prices. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising at a more normal pace.

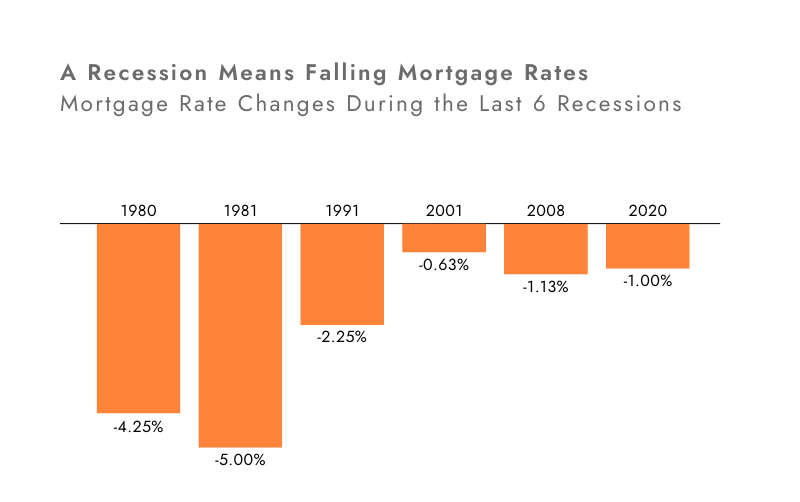

Mortgage Rates Typically Decline During Recessions

While home prices tend to stay on their current path, mortgage rates usually drop during economic slowdowns. Again, looking at data from the last six recessions, mortgage rates fell each time (see graph below):

So, a recession means mortgage rates could decline based on the data. While that would help with affordability, don’t expect the return of a 3% rate.

The answer to the recession question is still unknown, but the odds have gone up. But that doesn’t mean you have to wonder about the impact on the housing market – historical data tells us what usually happens.

Let’s Plan Your Next Move Wisely

Worried about what a recession could mean for your home plans? Let’s talk about what this data really means for your next move—whether you’re thinking of buying, selling, or just staying informed.

MY TAKE

Caroline's take on what you need to know

With so much talk of a recession, it’s easy to get caught up in the fear of what might happen. But when we look at the actual data, history tells a more reassuring story—home prices have remained steady or even risen in most past recessions, and mortgage rates often dip, offering some relief for buyers.

The key takeaway? Don’t make decisions based on headlines. Make them based on facts, goals, and timing that’s right for you. If you’re unsure what your next step should be, I’m here to help you sort through the noise and create a plan that works in any market.

We specialize in positioning our clients for success, whether buying or selling. If you're ready to make a move, let's strategize and ensure you’re making the most of this market. —contact us today!

Market Report April 2025

Here's the latest January 2025 Market Update showing year-over-year data. The data includes all Single-Family and Condo & Townhomes in the California Area sourced from Broker Metrics & Info Sparks for the period from January 2025 thru March 2025. This may include preliminary data and may vary from the time this data was gathered. All data is deemed reliable but not guaranteed.

FOR NEWS INQUIRIES

Kyle Henry

Director of Marketing

Kyle.H@CarolineHuo.com

650.727.1308

Share & Stay in the Know